Let Us Help You Navigate Medicare

Whether you're turning 65 or just need a refresher, this quick video breaks down everything you need to know — from Parts A, B, C, and D to Medicare Advantage vs. Supplement plans. No jargon, no confusion — just clear, simple answers to help you feel confident about your options.

Watch now and take the first step toward finding the right coverage for you!

What Is Original Medicare?

Original Medicare is the traditional government-run health insurance program for people 65 and older, and for some individuals under 65 with qualifying disabilities or certain conditions (like End-Stage Renal Disease or ALS).

It’s made up of two parts:

- Part A: Hospital Insurance

- Part B:

Medical Insurance

Original Medicare allows you to see any doctor or hospital that accepts Medicare nationwide — no networks or referrals needed.

What Does Each Part of Medicare Cover?

Part A – Hospital Insurance

- Inpatient hospital stays

- Skilled nursing facility care (after a qualifying hospital stay)

- Hospice care

- Some home health care

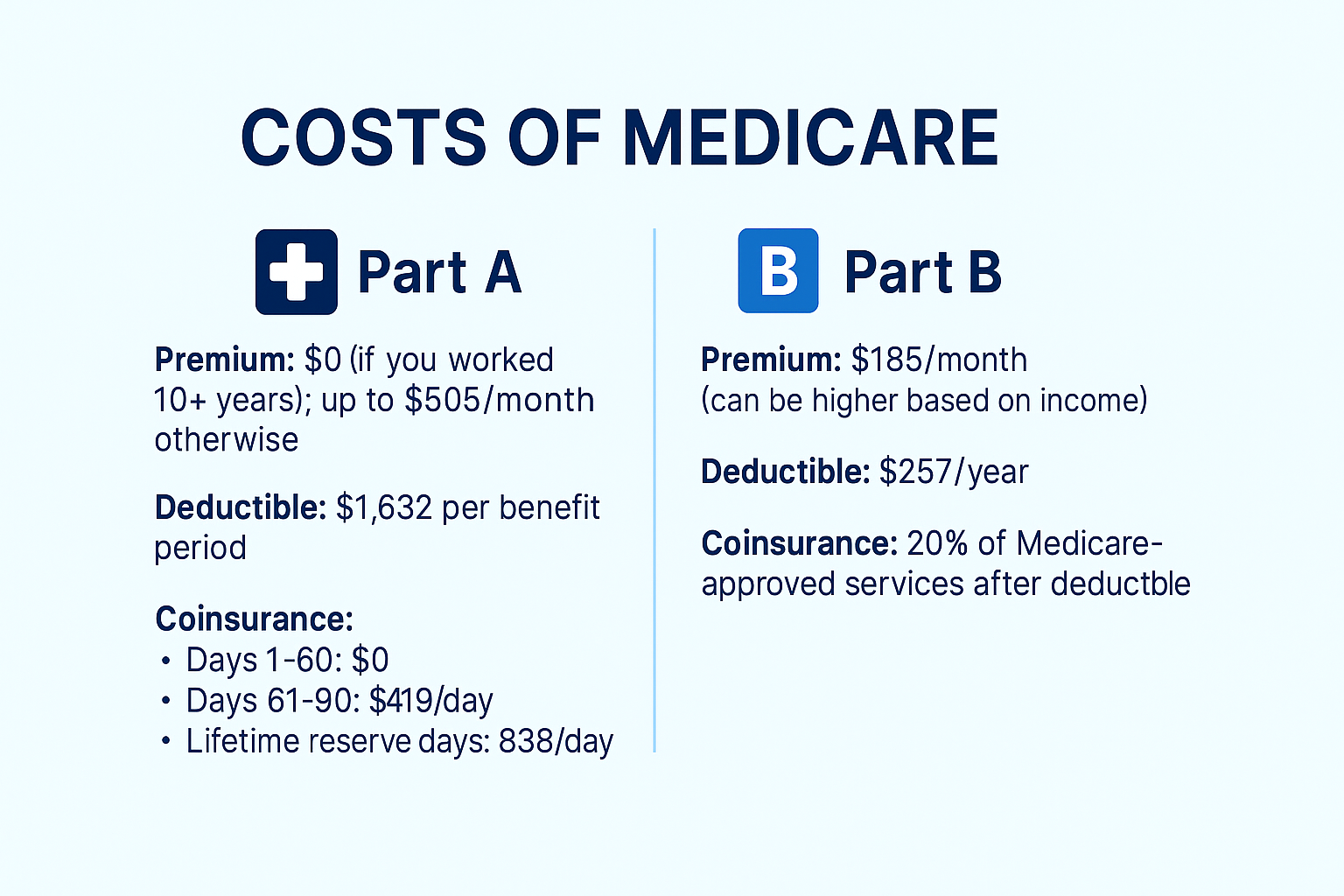

Most people don’t pay a premium for Part A if they or a spouse paid Medicare taxes while working.

Part B – Medical Insurance

- Doctor visits

- Outpatient services

- Lab tests, X-rays, and diagnostic screenings

- Preventive care (like flu shots and cancer screenings)

- Durable medical equipment (like wheelchairs or walkers)

- Mental health services (outpatient)

Part B requires a monthly premium and includes an annual deductible and 20% coinsurance on most services.

Part C – Medicare Advantage

- Offered by private insurance companies

- Includes everything in Parts A and B

- Usually includes Part D (prescription drugs)

- Often includes extra benefits like:

- Dental, vision, hearing

- Gym memberships

- Over-the-counter allowances

Must use a network of providers (HMO or PPO), depending on the plan.

Part D – Prescription Drug Coverage

- Covers outpatient prescription drugs

- Offered through private insurance companies

- Available as:

- A standalone plan (for Original Medicare)

- Or bundled in a Medicare Advantage plan

Each plan has its own formulary (drug list), premiums, and cost-sharing.

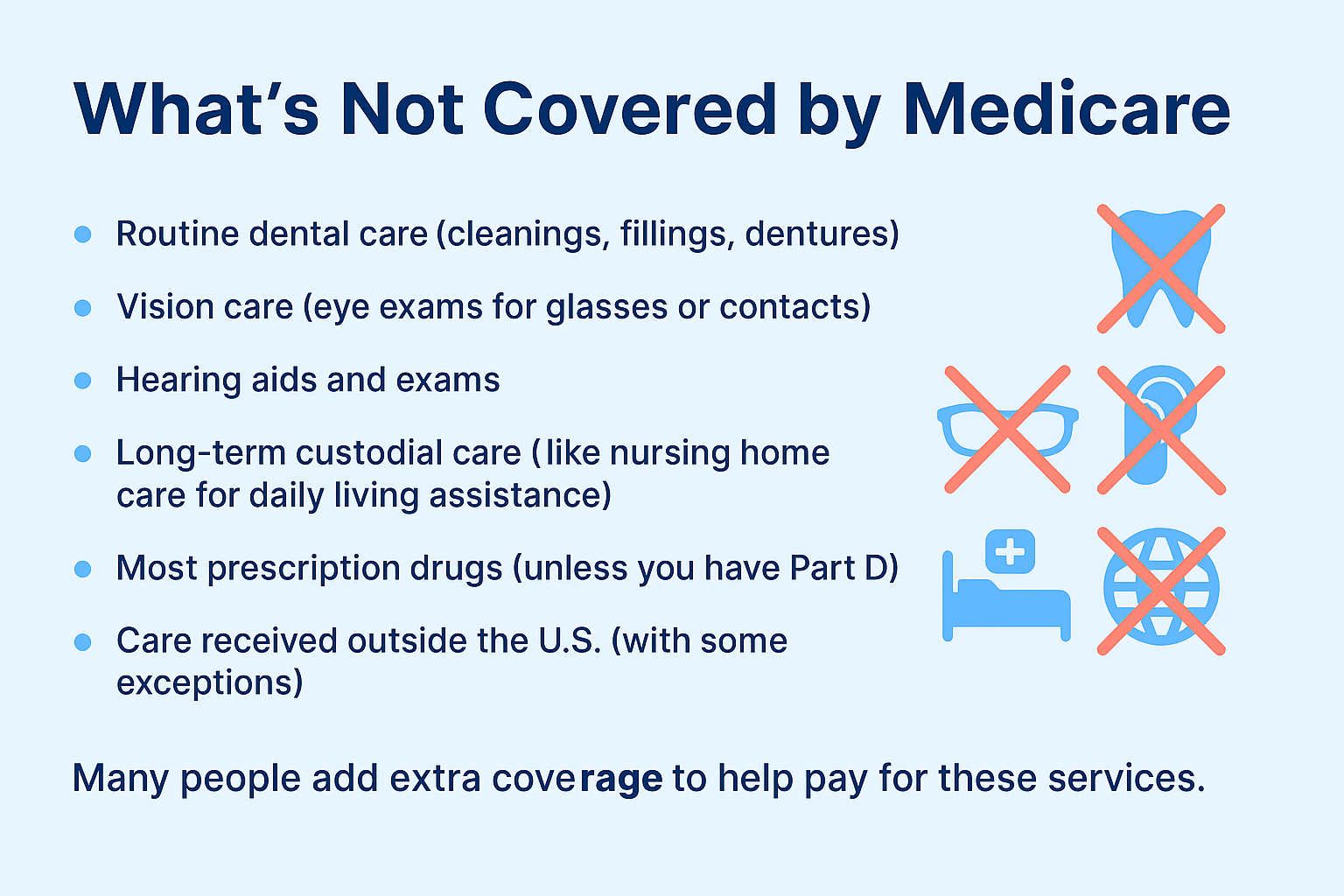

What Medicare Doesn’t Cover

While Medicare provides broad coverage, it doesn’t include everything.

Services like routine dental, vision, hearing aids, long-term care, most prescription drugs, and care outside the U.S. are typically

not covered.

Many people choose to add supplemental plans to help cover these gaps

Your Medicare Options

Option 1: Original Medicare Only

- You’re covered for hospital and medical services only

- Add Part D if you want drug coverage

- No cap on out-of-pocket costs

- Have to pay

20% co-insurance on all Part A and B services

Option 2: Medicare Advantage (Part C)

- All-in-one plan from a private insurer

- Usually includes drug coverage (Part D)

- May include extras like dental and vision

- You must use a provider network

- Has a yearly maximum out-of-pocket limit

- Subject to copays

Option 3: Medicare Supplement (Medigap)

- Helps pay the remaining 20% left over on your Part A and B services

- Works with Original Medicare, not with Medicare Advantage

- You can see any doctor that takes Medicare

- Doesn’t include prescription drug coverage (add Part D separately)

How to Decide What’s Right for You

Choosing the right Medicare path depends on:

- Your health and medications

- Your preferred doctors and hospitals

- Your travel needs

- Your budget for monthly premiums vs. out-of-pocket costs

Talking to a licensed Medicare agent can help you compare options side-by-side and avoid costly mistakes.